Choosing the right home insurance policy can be one of the most important decisions you make as a homeowner. Whether you’re buying your first home or reevaluating your existing policy, understanding what’s available and how to assess your needs is key to making the right choice. A good home insurance policy provides peace of mind, protects your assets, and ensures that you’re covered in case of unexpected events, such as fire, theft, or natural disasters.

In this comprehensive guide, we’ll walk you through the steps to help you choose the best home insurance policy, answer frequently asked questions, and provide a conclusion with key takeaways.

Key Takeaways:

- Home insurance protects your property from risks like fire, theft, and natural disasters, depending on the policy type.

- Assess your home’s value and belongings to ensure you have enough coverage.

- Replacement cost coverage is typically better than actual cash value, as it covers the full replacement cost of your property.

- Liability protection is crucial for protecting yourself financially if someone is injured on your property.

- Consider additional coverage or riders for specific needs, such as high-value items or natural disaster protection.

What Is a Home Insurance Policy?

A home insurance policy is a contract between a homeowner and an insurance company that provides financial protection against damage or loss to the home and its contents. It covers various risks, including natural disasters, fire, theft, vandalism, and personal liability for accidents that occur on the property. Essentially, a home insurance policy safeguards both the structure of your home and your personal belongings from unforeseen events that could otherwise lead to significant financial loss.

Home insurance policies typically consist of two main parts: coverage for the structure of your home and coverage for personal property inside the home. In addition to these, many policies also include liability coverage, which protects you if someone is injured while on your property or if you accidentally damage someone else’s property.

Key Components of a Home Insurance Policy:

- Dwelling Coverage (Structural Coverage):

This part of the policy covers damage to the physical structure of your home caused by perils such as fire, storms, theft, or vandalism. It typically includes the foundation, walls, roof, and other permanent fixtures attached to the home. In the event that the structure is damaged, this coverage helps you repair or rebuild it to its original condition. - Personal Property Coverage:

Personal property coverage protects your belongings inside the home, such as furniture, electronics, clothing, and personal items. It covers losses due to fire, theft, or vandalism, but may not cover certain high-value items like jewelry or artwork unless they are specifically included or endorsed. Most policies provide reimbursement based on replacement cost or actual cash value, depending on the terms. - Liability Coverage:

Liability protection covers legal and medical expenses if someone is injured on your property or if you are found responsible for damaging someone else’s property. For example, if a visitor slips and falls while on your property, liability coverage would help cover their medical bills and any legal costs associated with the incident. - Additional Living Expenses (ALE) Coverage:

If your home becomes uninhabitable due to a covered event, ALE covers the cost of living elsewhere while repairs are being made. This may include hotel stays, restaurant meals, and other expenses incurred while your home is being repaired or rebuilt.

Why Home Insurance Policy Is Important?

A home insurance policy is one of the most crucial safeguards for homeowners, providing protection for both the structure of your home and your personal belongings. The importance of home insurance extends beyond simply covering damage caused by unexpected events—such as fire, theft, or natural disasters—it ensures financial security, liability protection, and peace of mind. Here’s why a home insurance policy is essential:

1. Protection Against Property Damage and Loss

Home insurance protects the structure of your home and the personal property inside it against various risks, including:

- Fire: A fire can cause devastating damage to a home, and without insurance, rebuilding and replacing belongings would come at a significant financial cost.

- Theft or Vandalism: Homeowners are vulnerable to theft, burglary, and vandalism. A home insurance policy will cover the cost of replacing stolen or damaged items.

- Natural Disasters: Home insurance helps protect your home from natural disasters like storms, hail, earthquakes, and floods (though separate policies for floods and earthquakes may be necessary depending on your location).

- Accidental Damage: Accidents, such as accidentally breaking windows or flooding from an overflowing bathtub, are often covered by home insurance. This protection ensures that you won’t have to bear the full financial burden of fixing such problems.

2. Financial Security

The financial burden of repairing or rebuilding a home can be enormous. Without home insurance, homeowners would have to pay for repairs or reconstruction out of their own pocket, which may not be financially feasible. For example:

- Rebuilding After a Disaster: If your home is destroyed by fire, flood, or another disaster, home insurance helps pay for the reconstruction of the property.

- Personal Property Loss: If your belongings are damaged or stolen, insurance helps to replace them, ensuring that the homeowner does not bear the full cost of replacing furniture, electronics, and personal items.

The cost of replacing a home or its contents can be overwhelming, especially if you have valuable personal items. Home insurance mitigates this risk, offering much-needed financial protection.

3. Liability Coverage

Liability protection is one of the key reasons why home insurance is so important. This aspect of home insurance covers costs if someone is injured while on your property. This can include incidents like:

- Slip and Fall Injuries: If a visitor slips on an icy driveway or trips on a broken step, they could be injured. Liability coverage would help pay for their medical bills and any associated legal fees if they sue.

- Damage to Others’ Property: If a tree from your property falls onto your neighbor’s house, your insurance may help cover the repairs.

Liability coverage helps protect homeowners from potentially expensive lawsuits, giving them financial protection against unexpected injuries or damage to others.

4. Peace of Mind

One of the most significant reasons to have home insurance is peace of mind. Knowing that your home and belongings are covered can alleviate stress and worry. Without insurance, the uncertainty of facing unexpected events like a fire, flood, or theft can be overwhelming, and the financial implications of such events may be devastating.

Home insurance ensures that, should anything happen to your property, you will have the financial resources to recover. This sense of security allows you to live more comfortably, knowing that your home and possessions are protected.

5. Additional Living Expenses (ALE)

If your home becomes uninhabitable due to a covered event, such as a fire or natural disaster, your home insurance policy can provide compensation for additional living expenses. This coverage, known as Additional Living Expenses (ALE), typically covers:

- Temporary Housing: If you need to stay in a hotel or rent a temporary home while your house is being repaired or rebuilt, ALE will cover these costs.

- Food and Utilities: Homeowners may also receive compensation for food and utilities while they live elsewhere.

Having this coverage ensures that, in the event of significant damage to your home, you won’t have to worry about covering the cost of living in temporary accommodations while your home is being restored.

6. Mortgage Requirement

Most mortgage lenders require homeowners to have home insurance before they will approve a loan. If you have a mortgage, your lender wants to ensure that their investment in your property is protected in case of unforeseen damage or loss. If something were to happen to the home, the insurance policy would help repay the mortgage balance and prevent the lender from losing money.

In most cases, your lender will require you to maintain adequate coverage for the home throughout the duration of the loan. Home insurance ensures that both the homeowner and the lender are financially protected.

7. Protection from Unexpected Costs

Life is unpredictable, and home insurance is an important tool to protect yourself from unexpected financial burdens. Without insurance, homeowners might face significant out-of-pocket expenses for repairs, replacements, and legal fees. Some unexpected costs that can be covered by home insurance include:

- Accidental damage caused by guests or even family members (e.g., broken windows, walls, or electrical appliances).

- Legal fees resulting from a liability claim, such as if someone sues you after getting injured on your property.

- Medical expenses for guests who are injured on your property, particularly if the injury occurs due to no fault of their own.

Home insurance helps cover these costs, saving homeowners from potentially devastating financial burdens.

8. Insurance Can Cover High-Value Items

Many home insurance policies can be customized to cover high-value items such as jewelry, art, collectibles, electronics, or antiques. Standard coverage may have limits on the amount it will pay for these types of items, but you can typically purchase riders or endorsements to provide additional coverage. This is particularly useful for people who own items that are valuable or rare, and it ensures that those items are fully protected in the event of loss, damage, or theft.

9. Helps Cover Damage Caused by Natural Disasters

While not all natural disasters are covered by standard home insurance, certain events like hurricanes, tornadoes, and hailstorms are often included. However, certain disasters such as floods and earthquakes may require separate insurance policies.

- Flood Insurance: In flood-prone areas, homeowners may need to purchase additional flood insurance. Standard home insurance policies do not typically cover flood damage, but specialized flood insurance policies are available through the National Flood Insurance Program (NFIP) or private insurers.

- Earthquake Insurance: Like flood insurance, earthquake coverage is not included in most home insurance policies. If you live in an area prone to earthquakes, it’s a good idea to add this coverage to your policy.

For many homeowners, ensuring their property against the risks posed by natural disasters can provide significant peace of mind and financial security.

Understanding Home Insurance

Before diving into the specifics of selecting the right policy, it’s important to understand what home insurance is and what it covers. Home insurance is a type of property insurance that provides financial protection in the event that your home or personal property is damaged, destroyed, or stolen. It typically covers damage due to events like fire, storms, vandalism, and theft. Home insurance policies may also cover additional living expenses if your home is temporarily uninhabitable due to a covered loss.

There are different types of home insurance policies, and understanding these will help you make an informed decision when choosing the right one.

Types of Home Insurance Policies

- HO-1 Basic Form

The HO-1 policy provides basic coverage for a limited number of perils, such as fire, theft, and vandalism. However, it is not widely available and may be considered outdated. - HO-2 Broad Form

The HO-2 policy provides broader coverage than the HO-1, protecting against more than a dozen types of damage, including fire, lightning, windstorm, hail, theft, and vandalism. This type of policy is more comprehensive and is often recommended for homeowners who want a reliable safety net. - HO-3 Special Form

The HO-3 is the most common home insurance policy for homeowners and covers a wide range of perils, including all risks except those specifically excluded by the policy. This form is ideal for most homeowners because it offers extensive protection. - HO-4 Renters Insurance

Renters insurance covers the personal belongings of renters and liability protection but does not cover the physical structure of the rental property. This type of policy is only for tenants. - HO-5 Comprehensive Form

The HO-5 policy provides the highest level of coverage for homeowners, offering protection against all perils except for those that are explicitly excluded in the policy. It also covers both the structure of the home and personal property on a replacement cost basis rather than an actual cash value basis. - HO-6 Condo Insurance

This policy is designed for condominium owners and typically covers personal property and interior damage, as well as liability protection. It usually does not cover the exterior of the building or common areas, as those are typically covered by the condo association’s master policy. - HO-7 Mobile Home Insurance

This policy is similar to an HO-3 policy but specifically designed for mobile or manufactured homes. It covers both the structure and personal property, as well as liability protection. - HO-8 Older Home Insurance

The HO-8 policy is for older homes that may not meet modern building codes. It typically offers limited coverage and is more affordable for homes that are difficult to repair or replace at current market rates.

Factors to Consider When Choosing the Right Home Insurance Policy

Now that you understand the different types of home insurance policies, here are the key factors you should consider when choosing the right policy for your needs:

1. Assess Your Home’s Value

The first step in selecting the right home insurance policy is determining the value of your home and the assets inside it. This includes not only the cost to rebuild your home but also the value of your personal belongings. If you live in an area with a high risk of natural disasters, you may need additional coverage to protect against flooding, earthquakes, or hurricanes.

2. Evaluate Your Coverage Needs

Different policies offer different types of coverage, so it’s important to evaluate what you need. Basic home insurance policies may cover damages to your property from fire, vandalism, or theft, but they may not cover natural disasters such as floods or earthquakes. Make sure to choose a policy that provides adequate coverage for the risks you face.

3. Replacement vs. Actual Cash Value

Home insurance policies can cover your property based on replacement cost or actual cash value. Replacement cost coverage will pay to replace your property with a new one of similar quality, whereas actual cash value coverage takes depreciation into account and pays you the current value of your property. Replacement cost coverage is generally a better option if you want to ensure that you can fully replace damaged or lost items.

4. Deductibles and Premiums

The deductible is the amount of money you’ll need to pay out of pocket before your insurance coverage kicks in. The higher the deductible, the lower your monthly premium, and vice versa. Consider your budget and ability to cover the deductible in the event of a claim when choosing your policy.

5. Liability Protection

Liability protection is an essential part of home insurance. It covers legal costs and medical expenses if someone is injured on your property. Make sure that your policy includes adequate liability coverage, especially if you have a pool, trampoline, or other features that may increase the risk of accidents.

6. Add-Ons and Riders

Some home insurance policies allow you to add extra coverage for specific items or situations. Common add-ons include coverage for high-value items like jewelry, art, or antiques. Riders can also be purchased for things like sewer backups or home businesses. If you have special needs, these add-ons can be an essential part of your coverage.

7. Customer Service and Claims Process

Before purchasing a home insurance policy, it’s essential to research the insurance provider’s customer service reputation and claims process. A quick and hassle-free claims process can make a huge difference in the aftermath of a disaster. Look for insurers with strong customer service ratings and positive reviews from policyholders.

Also Read: How Health Insurance Policies Can Safeguard Your Financial Future

Conclusion

Choosing the right home insurance policy is essential for protecting your home, belongings, and financial future. By carefully assessing your needs, evaluating coverage options, and comparing policies from different providers, you can ensure that you select the best policy for your specific situation. Remember to look beyond the price and focus on the level of coverage, customer service, and claims process to make an informed decision.

Taking the time to understand your policy and its provisions will provide peace of mind, knowing that you are well-protected in the event of a disaster. Whether you’re a first-time homebuyer or an experienced homeowner, choosing the right home insurance policy is an investment in your home’s future.

Frequently Asked Questions (FAQs)

1. What is the difference between replacement cost and actual cash value in home insurance?

Replacement cost provides the money needed to replace your belongings with new items of similar quality, whereas actual cash value takes depreciation into account and reimburses you for the value of your belongings at the time they were lost or damaged.

2. Does home insurance cover natural disasters?

Most standard home insurance policies do not cover natural disasters like floods, earthquakes, or hurricanes. However, you can purchase additional coverage or separate policies for these types of events.

3. How do I know how much home insurance coverage I need?

To determine how much coverage you need, assess the replacement cost of your home and the value of your personal belongings. You should also consider the risks in your area (e.g., flood or earthquake risks) and the amount of liability coverage you want.

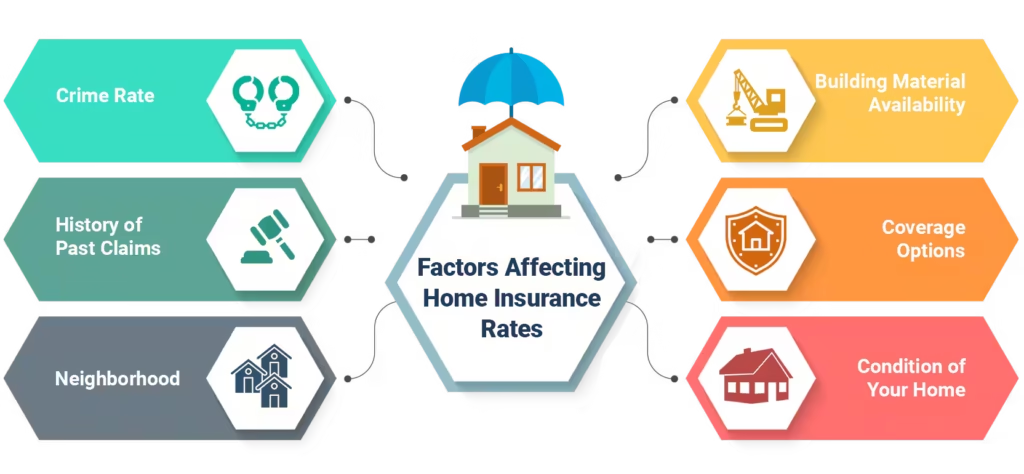

4. What factors affect my home insurance premium?

Premiums are influenced by factors like the value of your home, location, coverage limits, deductible, claims history, and the type of home insurance policy you choose.

5. Can I change my home insurance policy?

Yes, you can change your home insurance policy. If your needs change, you can adjust your coverage, increase your deductible, or add riders. It’s important to review your policy periodically to ensure it still meets your needs.

6. Is home insurance required by law?

Home insurance is not legally required in most states. However, if you have a mortgage, your lender will likely require you to carry insurance to protect their investment.

7. How can I save money on my home insurance?

To save on home insurance, consider bundling policies, increasing your deductible, improving home security, and shopping around for the best rates. Some insurers also offer discounts for things like having smoke detectors or a home security system.